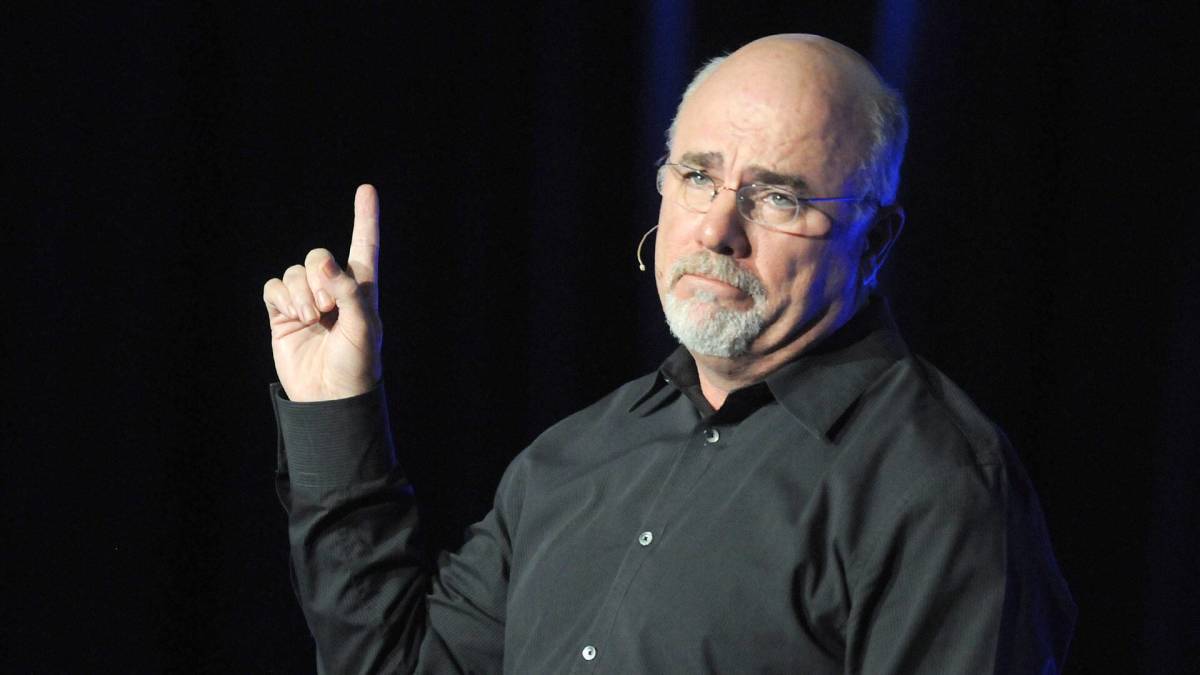

Dave Ramsey's Bold Warning on 401(k) Plans

Understanding Financial Priorities in a Volatile Economy

In today's unpredictable economic climate, American workers are facing increasing financial pressures. From rising housing costs to the growing expense of groceries and fuel, many individuals are struggling to manage their day-to-day expenses. Despite these short-term challenges, there is a strong commitment among workers to ensure long-term financial security through retirement savings.

Retirement accounts such as 401(k)s and IRAs play a crucial role in this effort. These investment vehicles offer a reliable way to build wealth over time, providing a safety net against economic downturns and helping individuals achieve financial stability in their later years. The structure of 401(k) plans, which deduct funds directly from paychecks, makes it easier for people to save consistently without needing to actively manage their investments.

Dave Ramsey’s Perspective on Retirement and College Savings

Personal finance expert Dave Ramsey has shared his views on the importance of prioritizing retirement savings over other financial goals, including saving for a child's college education. In an email to The News Pulse, Ramsey emphasized that while setting aside money for a child's education can be beneficial, it should not come at the expense of securing one's own future.

"Setting aside a college fund for your kids is a really nice thing to do, if you can actually afford that kind of thing," Ramsey wrote. "But kids can also further their education by getting good grades, applying for scholarships, choosing a school they can afford and working their tails off while attending classes."

Ramsey stressed that education is valuable, but it is not always necessary to have parents cover the entire cost. He pointed out that many successful individuals have achieved their goals without attending a four-year university, often working their way through school or pursuing career training at technical or trade schools.

Retirement as a Necessity

When it comes to retirement planning, Ramsey believes it should take precedence over other financial priorities. "Taking steps to begin saving for retirement comes before setting aside a college fund for kids, because everyone is going to retire someday," he said. "Unless, of course, they happen to die before reaching retirement age."

He continued, "So, in my mind funding retirement is basically a necessity. College, on the other hand, is a luxury. In fact, it’s often not the best route for someone to take when pursuing a career."

Ramsey acknowledged that not all parents can afford to contribute to their children's education. "There are many parents out there who, for one reason or another, can’t pay a dime toward someone’s education," he added. "And that doesn’t make them bad parents."

The Importance of Early Retirement Planning

Ramsey also highlighted the need for early retirement planning. "The last time I checked, there aren’t any good ways to retire that don’t require getting your finances ready for retirement well ahead of time," he wrote. "And that requires putting aside as much money as possible to live on during your golden years."

He warned against relying solely on Social Security, stating, "I don’t consider that to be a good plan — or a smart one." Instead, he advocated for proactive financial strategies that allow individuals to build a secure retirement fund.

Roth IRAs as a Smart Investment Option

In addition to 401(k) plans, Ramsey frequently recommends Roth IRAs as a preferred investment vehicle. He praised their flexibility, noting that investors can withdraw their contributions tax- and penalty-free after five years. Once individuals reach the age of 59-and-a-half, they gain full access to all funds, including earnings, without taxes or penalties.

Ramsey emphasizes the value of disciplined and strategic financial planning, which rewards long-term foresight and consistent saving. His approach underscores the importance of balancing immediate financial needs with long-term goals, ensuring that individuals are prepared for the future.

Post a Comment for "Dave Ramsey's Bold Warning on 401(k) Plans"

Post a Comment