China's Quant Firms Expand US Hiring Amid Visa Restrictions

Chinese Quant Funds Target US Students Amid Visa Challenges

Chinese quantitative hedge funds are intensifying their efforts to attract science and engineering students in the United States, particularly those affected by recent policy changes. These developments come as the Trump administration implemented stricter visa regulations and reduced funding for universities, creating a new landscape for talent acquisition.

One of the leading firms, Shanghai-based Mingshi Investment Management, has launched a special initiative to offer full-time positions to students who may not be able to complete their PhDs due to these policy shifts. The program also includes internships for graduates from Chinese universities whose overseas study plans have been disrupted. This move highlights a growing trend among Chinese quant funds to seize opportunities created by the evolving geopolitical climate.

Shanghai Goku Technologies, an AI-driven quant fund, has expressed openness to welcoming any qualified students impacted by the policies. Another major quant fund based in eastern China, managing over 10 billion yuan ($1.4 billion), has already hired three AI researchers this year, including individuals from the U.S. These actions reflect a broader strategy by Chinese firms to tap into the talent pool that is increasingly affected by U.S. immigration policies.

The shift in focus is driven by the heightened scrutiny on Chinese student visas under the Trump administration. Secretary of State Marco Rubio emphasized in May that some Chinese student visas would be "aggressively" revoked, signaling a significant change in how foreign students are treated. This has prompted Chinese quant firms, which have historically struggled to compete with global giants, to pivot their recruitment strategies.

Carrie Cheung, a Hong Kong-based partner at recruitment firm Principle Partners Pte., noted that the talent wars among top-tier global quant funds are intense, and now Chinese quant funds are actively participating in this competition. She added that the recent visa constraints make it a natural move to target U.S. graduate students.

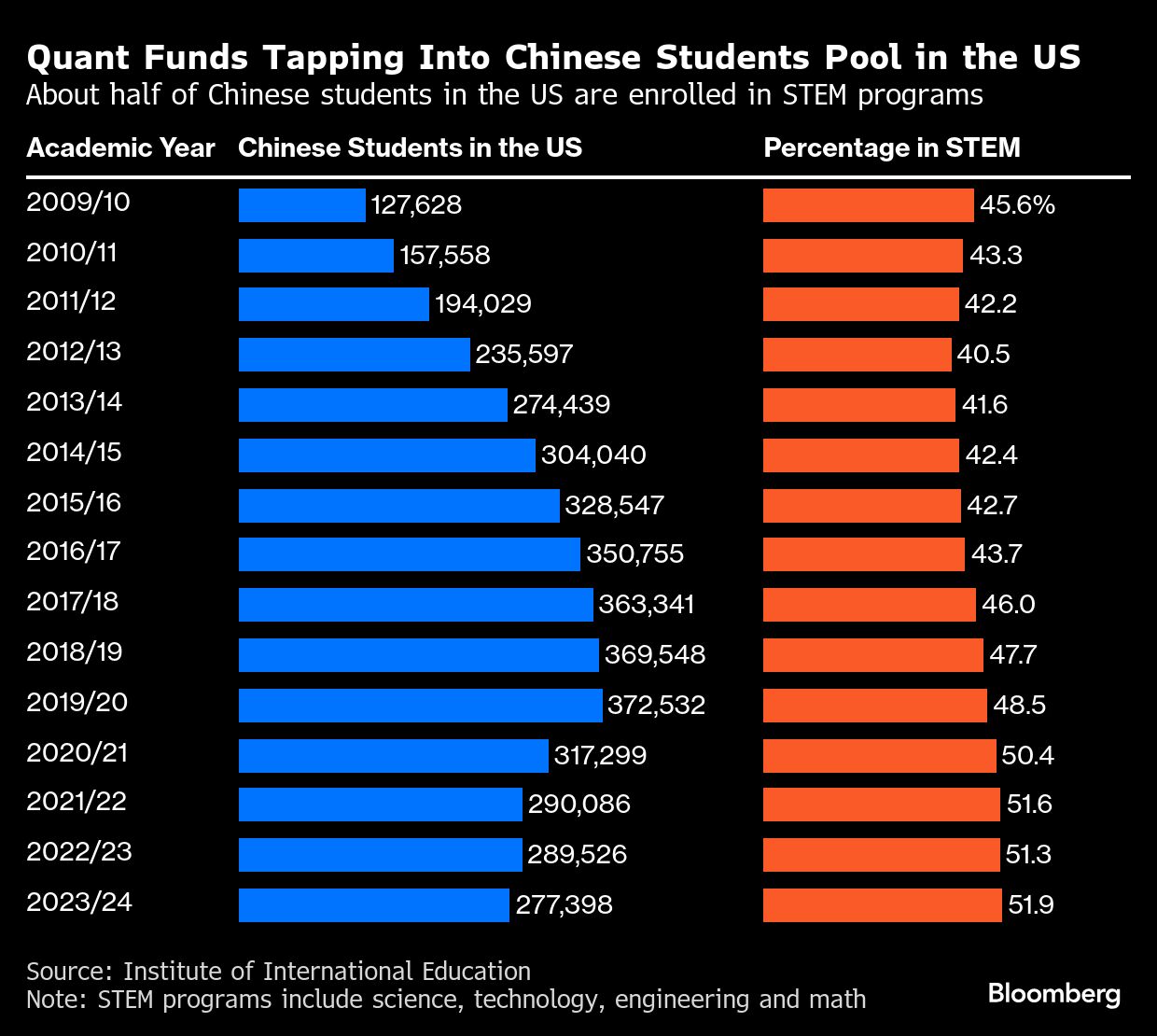

Mingshi, which oversees 15 billion yuan, has seen an increase in applications from science, technology, engineering, and math (STEM) majors. The firm has also hosted discussions with students from prestigious institutions like Yale University, emphasizing its commitment to engaging with potential talent.

Traditionally, over 80% of Mingshi’s recruits have been returnees from international universities or companies. However, the current situation has led to a shift, with more Chinese students in the U.S. returning home and fewer choosing to study abroad. This trend has accelerated this year, according to the head of human resources at an eastern China-based fund.

While the U.S. remains the top choice for most quant talent, its lead over China is shrinking. Some Chinese funds are offering more competitive pay and leveraging the industry's growing appeal, especially after the success of AI startup DeepSeek. About 40% of the unidentified eastern China fund’s research team are overseas returnees, mostly from the U.S., with some earning over 10 million yuan annually.

Shanghai QuantPi Investment Ltd. has experienced mixed results in competing for staff against international peers. CEO Sun Lin noted that more Chinese students studying in the U.S. are showing interest in Chinese quants. He attributed this to greater growth potential and a more familiar living environment, which offers a stronger sense of cultural identity.

QuantPi will not significantly alter its recruitment strategy, as it has always targeted individuals with U.S. and UK study experience. However, the company plans to allocate more resources to hiring, according to Sun, who previously served as the head of the U.S. market-making at Two Sigma Investments.

A key advantage for China is its vast talent pool. According to a Georgetown University research paper from 2021, Chinese universities are projected to produce more than 77,000 STEM PhD graduates per year by 2025, compared to about 40,000 in the U.S. This number could surpass the U.S. by more than three-to-one if international students are excluded from the U.S. count.

The rise in Chinese quant funds with at least 10 billion yuan in assets has reached 41, overtaking the 40 peers that use subjective strategies. This expertise is driving the incorporation of artificial intelligence into investment decisions. More than 95% of Goku’s trading signals are now AI-driven, significantly surpassing most global peers, which typically rely on up to 25% AI-driven signals.

Ken Chung, CEO of Goku’s Singapore unit, emphasized that the best source of AI talent is in the U.S. and China. If the U.S. doesn’t want that talent, he said, they would welcome them with open arms. This sentiment reflects the ongoing competition for top talent in the global quant industry.

Post a Comment for "China's Quant Firms Expand US Hiring Amid Visa Restrictions"

Post a Comment