$5.5 Trillion Vanish: Wall Street's Gamble Threatens US Economy

The resilience of the US economy throughout the past year has been notable, successfully navigating stormy forecasts that predicted recessionary squalls. A significant factor often cited in this unexpected durability is the substantial cushion of savings accumulated by American households during the unique circumstances of the pandemic era.

This financial buffer allowed consumers to continue spending, providing crucial support to the economy even as the Federal Reserve embarked on an aggressive campaign to increase interest rates, aiming to cool inflationary pressures that had intensified significantly since mid-2021.

However, a stark and concerning development is now coming into focus: the substantial erosion of these very savings. According to data highlighted by Barchart.com, the collective personal savings of Americans have plummeted by an astonishing $5.5 trillion since April 2020.

This dramatic decline, largely attributed to the persistent pressure of soaring inflation, suggests that the financial support once provided by these reserves is rapidly diminishing.

Indeed, the financial data provider tweeted that such reserves have now fallen to levels lower than before COVID-19, indicating a return to a more precarious financial state for many households compared to the peak savings period of the pandemic.

The initial surge in US household savings during the pandemic was spurred by a confluence of factors. Government stimulus checks provided direct financial support to many individuals and families, while restrictions on in-person activities and services naturally led to a drop in opportunities for discretionary spending.

This period saw a considerable increase in the aggregate cash held by American consumers, creating a substantial reserve. This accumulated cash pile has been instrumental in boosting consumer spending in the period following the relaxation of COVID restrictions, providing a vital engine for economic activity even as borrowing costs climbed due to the Federal Reserve’s actions.

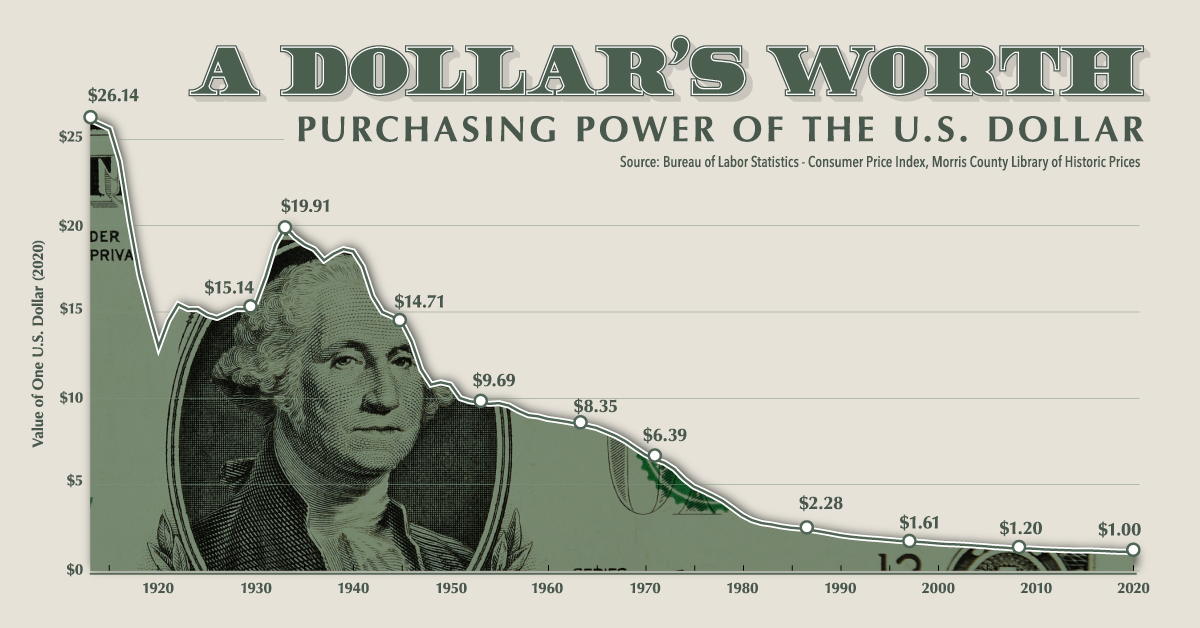

The primary culprit behind the rapid depletion of this savings reservoir has been historically high inflation. Since mid-2021, the purchasing power of the dollar has been significantly eroded as the prices of essential goods and services, ranging from energy to food, surged.

Inflation reached a peak, hitting a 40-year high of 9.1% in the summer of 2022. While inflation has since moderated to 3% as of last month, a positive development attributed to the Federal Reserve’s determined efforts to raise benchmark borrowing costs – increasing them by 500 basis points since early 2022 – the damage to accumulated savings had already been substantial.

The stated objective of the US central bank’s aggressive rate hikes is, of course, to bring inflation back down to its long-term target of 2%. However, the pathway to achieving this goal has involved making borrowing more expensive, a factor that can itself dampen economic activity.

The interplay between past inflation eating savings and higher current borrowing costs presents a complex challenge for the economy. The cushion that helped absorb some of the shock of rising prices and interest rates is now considerably thinner.

Adding further pressure to the financial situation of American households and potentially impacting consumer spending is the return of student loan repayment obligations. After a prolonged pause, these payments are resuming, introducing a new mandatory expense for millions of borrowers.

This resumption of payments is expected to cut into both the ability of individuals to save money and their capacity for discretionary spending. It represents a direct reduction in disposable income for a significant segment of the population.

A recent report from Oxford Economics provides a quantitative perspective on this potential impact, forecasting that US consumer spending could fall by more than $100 billion a year specifically as a result of student loan payments kicking back in.

Such a reduction in consumer expenditure, a key driver of economic growth in the United States, naturally lifts the odds of an economic downturn, further compounding the risks posed by depleted savings.

Simultaneously, a separate, yet potentially intertwined, set of concerns is emanating from the financial markets. Data from Goldman Sachs has revealed a dramatic surge in ‘short’ positions taken against US stocks, a move that signals a collective belief among certain sophisticated investors that the market is headed for a significant decline.

Betting against the market in this manner represents a multi-billion-dollar gamble being placed by hedge funds, effectively wagering against the continued strength of the US economy and its stock market.

The scale of this bearish sentiment is striking. Throughout the month of January, investors placed bets on American stocks falling at a rate 10 times greater than the bets placed on their continued rise.

This staggering shift reflects a growing unease among a segment of Wall Street regarding the future trajectory of the market, particularly, as highlighted in the context, under the potential leadership of Donald Trump.

The timing of this notable financial maneuver appears to be intricately linked with recent market events and shifts in investor sentiment. It comes just as the world witnessed a substantial $600 billion wipeout in the value of major US technology stocks earlier the same week.

This significant sell-off was reportedly driven, at least in part, by fears surrounding the emergence and capabilities of a Chinese AI rival known as DeepSeek.

This disruption to the technology sector struck at the heart of what had previously been considered the almost unshakable dominance of America’s leading technology companies, particularly the group collectively known as the Magnificent Seven.

The Magnificent Seven – comprising Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla – had been instrumental in driving market gains for a considerable period. However, as the context notes, they all suffered massive losses in the wake of these developments, leaving investors scrambling for answers and reassessing their positions.

Chipmaker Nvidia, which had experienced a significant surge in value throughout the previous year, was particularly hard hit. It was reported to be down over 18 percent in just five days and suffered an eye-watering loss of $589 billion in value on a single Monday alone.

These recent hedge fund moves represent a remarkable reversal from a sentiment prevalent just a couple of months prior. At that time, many Wall Street billionaires were actively pouring money into investment strategies broadly labeled as ‘Trump trades.’

Following what was perceived as his election victory, hedge funds had rushed to capitalize on expectations of what they predicted would be a ‘golden era for corporate America.’ This optimism was buoyed by the anticipation of Trump’s aggressive tax cuts, potential tariffs, and deregulation policies, which were seen as potentially highly favorable for corporate profitability.

This positive outlook led to an unprecedented influx of capital into hedge funds, pushing their total assets to a record high of $4.5 trillion. Fund managers, riding high on this wave of capital, were evidently convinced that Trump’s return to power would usher in a new stock market boom.

Yet, in what the context describes as a shocking twist, those very same hedge funds that had championed this optimistic outlook are now positioning themselves to bet against the economy and market they once viewed so favorably.

This dramatic shift in sentiment carries significant implications, not just for the financial elite executing these trades, but potentially for millions of everyday American investors. While hedge fund billionaires stand to potentially make hundreds of millions from a significant stock market collapse, the text warns that the real victims of this financial gamble could be ordinary citizens.

Millions of workers across the United States rely on their 401(k)s and pension funds as primary vehicles to secure their financial futures and provide for their retirement. These accounts are directly tied to the performance of the stock market.

As hedge funds place enormous bets predicting a Wall Street wipeout, these crucial savings accounts, upon which so many Americans depend, could be the next to suffer substantial losses, potentially jeopardizing retirement security for a vast number of people.

The rapid and pronounced shift in market sentiment, particularly the surge in short positions, has not gone unnoticed and has raised red flags among financial analysts, sending what are described as alarm bells ringing all the way to Capitol Hill.

Expert opinions are beginning to surface, attempting to explain this complex dynamic. Bruno Schneller, a managing partner at Erlen Capital Management, was quoted by the Daily Telegraph stating that ‘The increase in short bets against U.S. stocks likely reflects concerns about macroeconomic uncertainty.’

Analysts at UBS have echoed this sense of unease regarding the outlook. Karim Cherif, who heads alternative investments at UBS, was quoted acknowledging that ‘As the new year unfolds, uncertainties persist regarding Trump’s policies, the global economic trajectory, and central bank actions.’ These statements underscore the multifaceted nature of the current economic and market landscape.

Even highly influential players within the financial world are sounding the alarm. Elliott Management, a hedge fund giant reportedly managing over $70 billion in assets, is among those expressing concerns.

According to information reported by the Financial Times, executives at Elliott believe that some of Trump’s potential policies could be fueling ‘speculative bubbles’ in the market.

Their view is that if these bubbles were to burst and markets were to crash, it could ‘wreak havoc,’ a strong term suggesting potentially severe and widespread financial damage.

Related posts:

A $5.5 trillion savings wipeout is raising risks for the US economy

Hedge funds’ massive bet on stock market crash raises alarm for 401(k)s – and risks ire of Trump

Post a Comment for "$5.5 Trillion Vanish: Wall Street's Gamble Threatens US Economy"

Post a Comment