North Canton Leaders Celebrate as Voters Approve Income Tax Increase

(This narrative has been revised to address errors. Please see the correction noted at 4:30 p.m. on May 7.)

North Canton — Residents of the city have endorsed Issue 4, which will permanently raise the local income tax rate from 1.5% to 2%, starting January 1st.

The non-official tally shows 1,854 votes for the tax hike versus 1,517 against.

Following the rejection of tax hikes aimed at funding the fire station in both November and March of the previous year, city officials were elated with Tuesday’s outcomes.

“I am thrilled. I simply want to express my gratitude to the voters of North Canton who made their voices heard,” stated Mayor Stephan Wilder.

"As this passes, the electorate is contributing to the creation of a community that we all aspire to be part of and one that will benefit future generations. This marks a positive step for North Canton as it moves forward and continues to deliver crucial services to our residents,” remarked Council President Matthew Stroia, At Large. "I am highly enthusiastic about the prospects for North Canton. The outcome was significant; I believed our proposal was quite equitable. It assisted many individuals on fixed incomes and senior citizens who have been particularly challenged by rising property taxes. Everyone seems thrilled," he added.

Each North Canton resident, irrespective of whether they work within this city or elsewhere, along with those who do not live here but earn their living in North Canton, must contribute an additional 0.5%, which equates to $5 extra for every $1,000 earned. Meanwhile, the deduction provided to locals whose jobs are outside the city stays limited to a maximum of 1.5% of their earnings.

It is anticipated that the tax hike will generate an additional $3.6 million to $3.7 million annually.

After the certification of the Issue 4 vote, Stroia stated that he would urge the council to pass legislation by mid-July to keep their promise made in February. They had pledged to cease collecting taxes for three charges provided that voters supported the issue.

This proposed law aims to eliminate the city’s 1.5-mill fire levy and 3.3-mill emergency services levy, which were set for their final collection in 2027 but will now conclude sooner. These collections are slated to wrap up later this year prior to an increase in income taxes taking effect in January. Additionally, council plans not to pursue renewal or replacement of the city’s 1-mill road levy once these funds dry up at the close of this year. Overall, homeowners in North Canton stand to save around $131 annually per every $100,000 worth of property due to this change. Combined, those three levies brought in roughly $2.7 million each year previously.

Stroia mentioned that the council intends to honor its other obligations as well. The plan involves allowing the city to issue approximately $16 million worth of bonds to investors to fund the building of a new fire station located at the intersection of Viking Street NW and North Main Street. Annually for 25 years, the council plans to set aside roughly $1 million from increased income taxes towards repaying this debt. However, due to contributions totaling $750,000 pledged by the Hoover Foundation spread across three years, the annual payment might end up being somewhat lower each year. Additionally, any leftover money generated from the hike in income taxes would go toward supporting both fire department and emergency medical services operations along with street maintenance, compensating for the loss incurred following the cancellation of previous levies.

Record of denials in North Canton

The vote May 6 comes after 51% of city voters in November rejected a 25-year, 1.97-mill bond levy to finance the fire station. They also declined to replace the street levy. In March 2024, around 60% of voters in the city turned down a rise in the income tax rate from 1.5% to 2%, but this decision was not accompanied by a commitment from the council to discontinue property tax collections.

Local authorities claim that the city requires a new fire station since the present facilities are inadequate. The garages at both existing stations cannot accommodate contemporary firefighting trucks comfortably. Dispatching personnel and emergency responders from two separate spots isn’t optimal either. Furthermore, these older stations do not offer enough room nor adequate private areas. Additionally, they aren't equipped with systems capable of containing hazardous substances released during fires from contaminating the surrounding area.

Voters' views

Philip Yakunich, aged 74, a former postal employee who submitted his vote on May 6 at the North Canton Civic Center, mentioned that he supported the raise in the income tax rate.

He mentioned that this measure aims to slightly lower property taxes," regarding the council’s commitment to let fire, EMS, and road funding measures expire or be repealed if voters support Issue 4. "Should it pass, they will allow three different property tax levies to lapse.

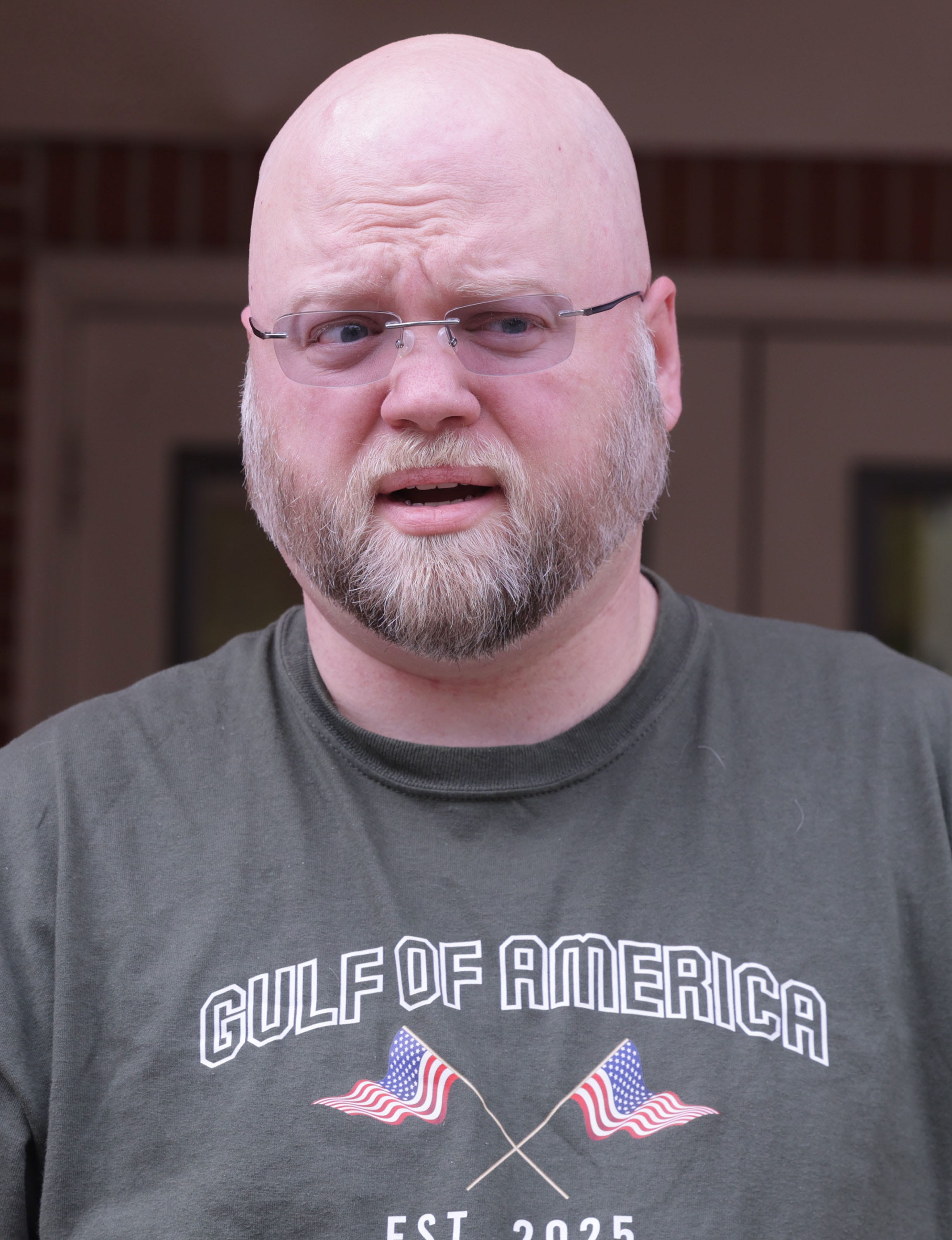

Daniel Anschutz, who is 42 years old and works as a chef, expressed his opposition to the increase in income tax.

I appreciate the modifications implemented; however, I believe more significant adjustments aligned with the correct path are necessary," stated Anschutz. "Everyone must be responsible for contributing funds properly so we can cover all associated costs accordingly.

Randy Elsass, who is 65 years old, stated that he supported Issue 4 to fund the building of a new fire station.

“If when our lady firefighters enter a blaze where foam needs to be used or another type of retardant, they lack facilities for cleaning up at the older fire stations,” he stated. “In fact, during colder weather, they end up being rinsed down outside near the back of the structure. They then must walk through the living areas and temporarily section off a restroom area just to provide them with a private space to change clothes. This situation seems unacceptable to me.”

Elsass’ mother, Sandy Elsass, who is 86 years old, admitted she was hesitant about voting on the income tax increase because she wasn’t employed anymore. She reasoned that the rise wouldn’t impact her directly. Nonetheless, she decided to support the income tax boost to ensure the council would let expire or abolish the three property tax measures.

"Nevertheless, since I pay substantial property taxes, that motivated me to cast my vote in favor of it," Sandy Elsass stated.

Reach Robert at robert.wang@cantonrep.com.

Correction The proposed 0.5% rise in income tax would generate an additional $5 for every $1,000 earned. North Canton plans to take out a loan of $16 million to fund the construction of a new fire station. It should be noted that the previous edition of this piece incorrectly stated the figures involved.

The article initially appeared on The Repository. Leaders in North Canton celebrate as voters agree to pass the Increase in Income Tax under Issue 4.

Post a Comment for "North Canton Leaders Celebrate as Voters Approve Income Tax Increase"

Post a Comment