America's Seniors Lost Billions to Crypto Scams—Here’s How We Can Stop It

For many years, we have developed regulations aimed at safeguarding elderly individuals from exploitative lending practices and unscrupulous care providers. However, could we be overlooking the cyber dangers they encounter as they engage in online transactions? The FBI’s most recent Internet Crime Report (IC3) underscores this somber truth when examined closely.

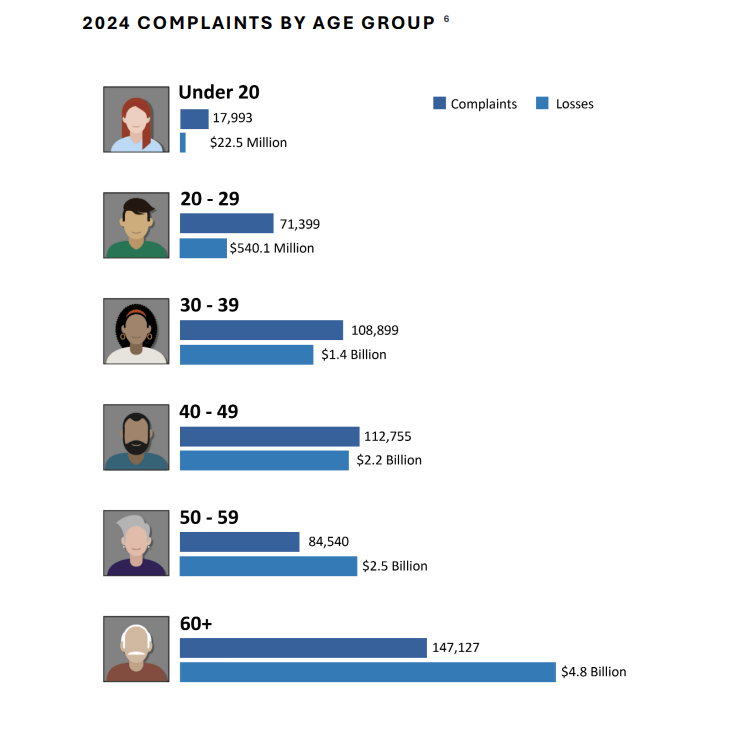

According to the IC3 study In 2024, individuals aged 60 and older in America suffered losses totaling $4.8 billion due to cybercrimes, marking a 43% increase from the previous year. Additionally, the data highlighted another concerning trend: these victims submitted 147,127 complaints, with approximately 7,500 reporting losses exceeding $100,000 each. This figure surpasses all other demographic groups.

This goes beyond merely a financial crisis; it illustrates a systemic failure in safeguarding a generation that has amassed the nation's wealth yet still faces severe vulnerabilities when it comes to digital threats.

What does it reveal about us if we permit our elders like parents and grandparents to become targets of online persecution? When we accept the betrayal of those who trusted us as they face exploitation? This goes beyond mere cyber security concerns; it serves as a measure of our collective morality. At present, we are not passing this test.

Why are seniors more susceptible to cybercrime?

Cybercriminals focus their attacks on older individuals due to various factors. Primarily, many retired people have accumulated substantial lifetime savings, own homes free of mortgages, and tend to place their faith in financial entities such as banks or governmental organizations—entities frequently mimicked by fraudsters.

Moreover, gaps in digital literacy have left many navigating online financial platforms without the required safeguards. That’s compounded by the advancement in today’s scams that are nothing like the clunky, typo-ridden emails of yesteryear. Instead, they’re subtle, personalized, and engineered by suave global crime syndicates, as the screenshot below shows.

Another factor heightening our seniors’ vulnerability to online financial crimes is their isolation. Nearly 1 in 3 adults over 65 live alone, and loneliness makes them ready targets of romance and impersonation scams.

We need to reconsider our systems.

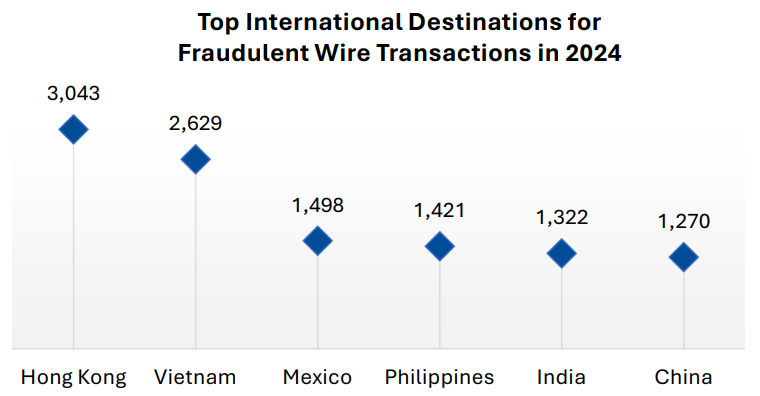

In general, the IC3 report serves as a stark criticism of how our institutions struggle to stay abreast of changing criminal patterns. For example, financial service providers often do not have effective real-time fraud detection systems. Indeed, our banks may identify suspicious cash withdrawal activities. However, they might overlook international wire transfers. crypto exchanges , even when retirees withdraw their IRAs all at once overnight.

When compared with Europe, where French commercial banks prevent dubious transactions promptly and German initiatives like the "Digital Compass" educate older adults about recognizing online scams, the U.S. falls behind since it primarily holds individuals responsible for preventing senior fraud instead of addressing it as an overarching issue.

Once more, we've poured billions into cybersecurity infrastructure. However, we've neglected to bolster support for those least prepared to handle online threats. Currently, very few states require fraud education as part of their aging programs, which leaves numerous elderly individuals struggling with the transition to digital finances.

Ultimately, the government’s approach to this issue continues to be disjointed and inadequately funded. Although the SEC actively monitors activities on Wall Street, elder cybercrimes fall between the cracks of the FBI, FTC, and various local authorities without clear oversight. As a result, these divisions lead to discrepancies in both safeguarding measures and law enforcement efforts across different regions.

Elderly Americans are being swindled out of more funds through cryptocurrency frauds compared to any other type of scam.

A startling statistic from the FBI’s report reveals that Americans aged 60 and older lost $2.8 billion to cryptocurrency frauds in the previous year. This figure identifies them as the demographic hardest hit by such schemes.

The majority of these losses were due to investment scams ($1.8 billion), including “pig butchering .”

This grotesquely accurate nickname refers to long-con schemes that lure victims into fake online relationships with promises of crypto riches. After winning their trust, the perpetrator then bleeds their victim dry.

However, cryptocurrency is not the sole menace. Scams conducted through call centers have also surged in profitability, particularly when they pose as technical support services or governmental organizations. In 2024, U.S. senior citizens disclosed losses of $982 million due to tech support fraud. This sum exceeds the yearly income of several Fortune 500 enterprises.

In the midst of despair, one of the agency’s programs—Operation Level Up—provides a glimmer of hope. This initiative enabled both the bureau and their Secret Service partners to identify 4,323 possible crypto fraud victims and take action, preventing them from losing an estimated total of approximately $286 million collectively.

Although praiseworthy, these responsive actions are just temporary fixes for a severe problem: What we really require are more robust, long-term solutions to address the issue at its root cause.

Therefore, what steps can we take to close the gap?

To protect both our elderly and ourselves from cybercrime, here’s what we should undertake. Firstly, we ought to allocate resources towards specialized education aimed at our senior citizens. This can be achieved by crafting informational initiatives designed around their requirements and disseminating these programs via user-friendly platforms such as local gathering spots, public lending libraries, and medical offices.

Moreover, America needs to increase access to victim support services like mental health assistance and financial guidance. Simultaneously, there should be efforts to educate the public on removing the stigma associated with being a victim. By doing so, individuals who have been victims of online scams might feel more comfortable sharing their experiences, which could lead to identifying and taking action against their perpetrators.

Both the finance and technology sectors need to intensify their commitment to introducing age-appropriate safety features and fraud prevention strategies for seniors. Additionally, these industries should increase their monitoring and disclosure of unusual electronic fund transfers, especially when cryptocurrencies or international accounts are involved. By doing so, they will support law enforcement agencies in identifying patterns and safeguarding individuals who may be at risk of online scams.

Households and neighborhoods need to assume primary responsibility for instructing and safeguarding elderly members and acquaintances. It’s important for them to engage in candid discussions regarding frauds and guide senior citizens on ways to authenticate requests through non-digital means rather than clicking links sent via email.

safeguarding elders goes beyond just being a ethical duty.

IC3 statistics highlight a concerning trend where scammers are evolving more rapidly than financial institutions can keep up with. This underscores the necessity of securing older adults' assets as both an ethical obligation and a sound economic strategy. Seniors over 60 represent a vital segment of society; hence ensuring their financial security is essential for maintaining overall consumption levels, supporting health care services, and fostering trust across generations.

The alternate scenario? A future where retirement isn't a prize earned after years of labor but a gateway for anonymous threats.

The News PulseAcademy: Launching Soon – Discover a Novel Approach to Generating Passive Income via DeFi in 2025. Learn More

Post a Comment for "America's Seniors Lost Billions to Crypto Scams—Here’s How We Can Stop It"

Post a Comment